In an era where digital solutions streamline every aspect of our lives, budgeting and expense tracking apps have emerged as powerful tools for managing personal finances. These applications have transformed the way people monitor their spending, save money, investment and work toward financial goals, making financial management more accessible and efficient than ever before.

The Evolution of Budgeting Apps

Since their introduction, budgeting applications have undergone considerable advancement. Early versions were often limited to manual entries with basic categorization. Modern applications utilize artificial intelligence, machine learning, and open banking technologies to deliver real-time insights, forecast spending behaviors, and offer tailored financial guidance.

Understanding the Landscape

The market for financial management apps has exploded in recent years, offering solutions for every type of user – from financial novices to seasoned investors. These apps typically fall into several categories: basic expense trackers, comprehensive budgeting platforms, and full-service financial management tools. Each category serves different needs and user preferences, making it crucial to understand what’s available before choosing the right tool.

Core Features of Modern Financial Apps

Today’s leading financial apps offer a robust set of features that go far beyond simple expense tracking. Most popular platforms include:

- Automatic Transaction Synchronization: By connecting directly to users’ bank accounts and credit cards, these apps automatically import and categorize transactions, eliminating the need for manual entry. This real-time tracking ensures that users always have an up-to-date view of their financial situation.

- Customizable Budgeting Tools: Users can create personalized budgets across various categories like groceries, entertainment, and utilities. Many apps use visual representations such as graphs and charts to make budget tracking more intuitive and engaging.

- Real-Time Budgeting: Apps now offer real-time updates on your spending against your budget, alerting you when you’re nearing or have exceeded your limits in specific categories.

- Spending Analysis: Advanced analytics tools help users understand their spending patterns by breaking down expenses into categories and providing insights into where money goes each month. This data-driven approach helps identify areas for potential savings.

- Bill Payment Reminders: To help users avoid late fees and maintain good credit scores, many apps include bill tracking features and payment reminders. Some even offer automated bill payment capabilities through their platforms.

- Savings Goals: Goal-setting features allow users to establish and track progress toward specific financial objectives, whether it’s building an emergency fund, paying down debt, saving for a vacation, or planning for retirement. They offer motivational tools like progress charts and reminders.

- Subscription Management: With numerous subscription services in today’s economy, apps like PocketGuard and YNAB highlight recurring charges, helping users to manage or eliminate unnecessary subscriptions.

- Investment Tracking: Some apps, like Empower (formerly Personal Capital), integrate investment tracking, providing a comprehensive view of one’s financial status, including net worth calculations.

Popular Apps in the Market

While numerous options exist, several apps have distinguished themselves through their unique features and user-friendly interfaces:

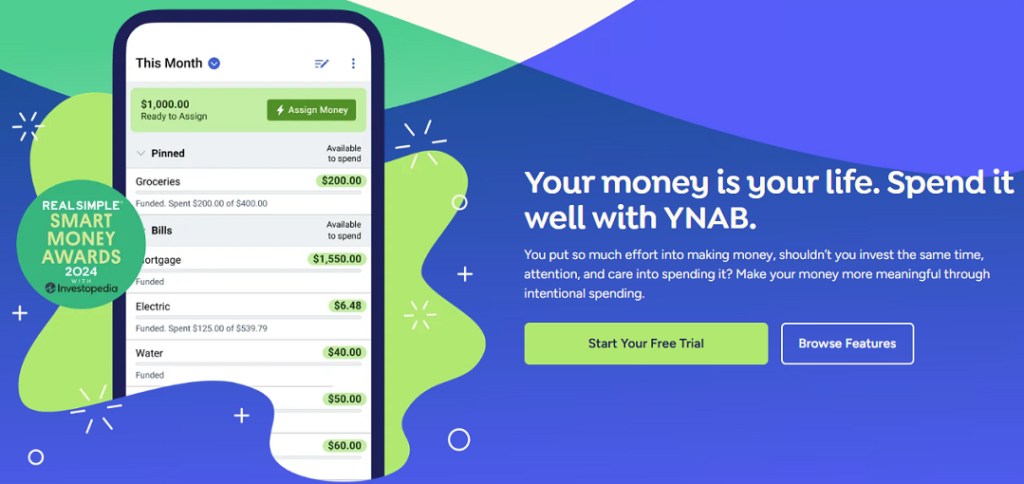

You Need a Budget (YNAB)

YNAB is renowned for its zero-based budgeting approach, where every dollar is assigned a specific purpose. It emphasizes proactive budgeting, encouraging users to plan their spending before they earn.

It excels at helping users break the paycheck-to-paycheck cycle through its four-rule methodology: Give Every Dollar a Job, Embrace Your True Expenses, Roll With the Punches, and Age Your Money. Key features include automatic bank syncing, goal tracking, and educational resources like workshops and podcasts.

Pros: Offers real-time syncing across devices, detailed reporting, and goal tracking. Great for learning solid budgeting habits; offers a 34-day free trial and is free for college students.

Cons: Can be pricey for some users at $14.99/month or $99/year; requires active engagement due to its detailed approach; steeper learning curve.

Cost: $14.99/month or $99/year.

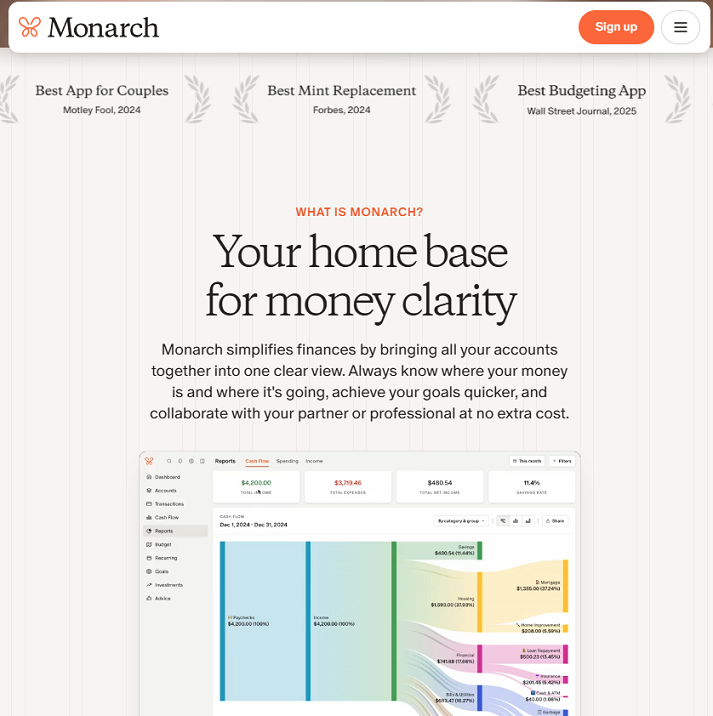

Monarch Money

A newer entrant to the market, Monarch Money has gained popularity for its clean, modern interface and comprehensive financial management features with a focus on personalization and collaboration. It offers investment tracking, net worth monitoring, and customizable budgeting tools. Users can customize their dashboard, set savings goals, and manage shared finances with partners.

It integrates with numerous financial institutions for real-time tracking.

Pros: The app stands out for its powerful investment analytics and the ability to create multiple scenarios for financial planning. User-friendly interface; strong for couples or families; offers a 7-day free trial. Particularly appealing to users who want both budgeting and investment tracking in one platform.

Cons: No free version; subscription cost might be high for some at $14.99/month or $99.99/year.

Cost: $14.99/month or $99.99/year after trial.

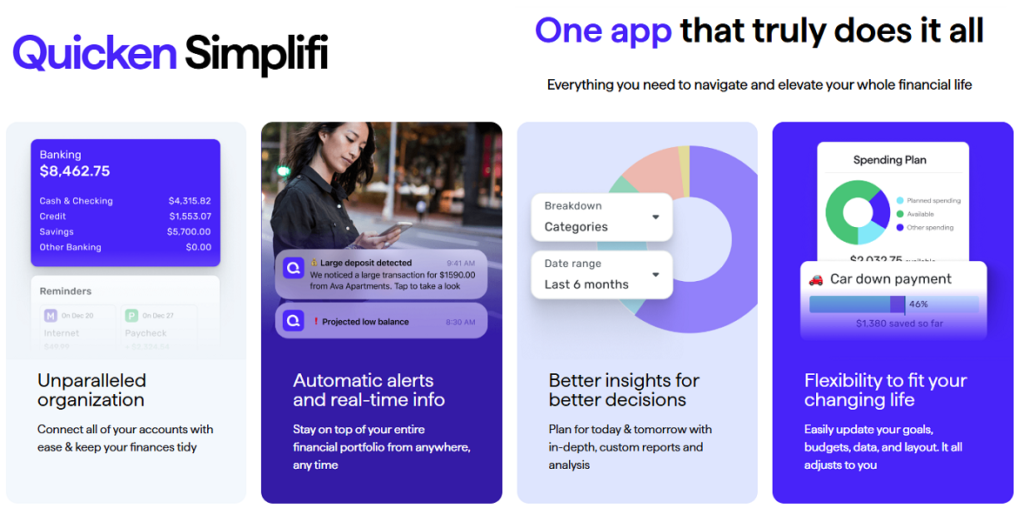

Quicken Simplifi

Simplifi by Quicken offers detailed spending plans based on real income and expenses, customizable reports, and investment tracking. It’s known for its ability to adapt to users’ financial behaviors over time. The app offers a unique “spending plan” approach rather than traditional budgeting, making it less restrictive while still maintaining financial awareness.

Pros: Tailored to users with complex financial lives; includes a 30-day money-back guarantee.

Cons: No free version; subscription at $5.99/month or $35.99/year.

Cost: $5.99/month or $35.99/year.

PocketGuard

PocketGuard focuses on simplicity and automation. It calculates your “In My Pocket” money after bills and goals, offering a snapshot of how much disposable money you have after accounting for bills, goals, and necessities. It’s user-friendly, focusing on simplicity with features like bill negotiation services through Billshark. The app automatically finds potential savings in your recurring bills and subscriptions.

Pros: Offers a free version; good for those new to budgeting.

Cons: Premium features require payment; some users report issues with syncing.

Cost: Free version available; PocketGuard Plus at $12.99/month or $74.99/year.

Goodbudget

Based on the envelope budgeting system, Goodbudget is ideal for users who prefer a more traditional approach to budgeting. Users allocate money into virtual envelopes for different spending categories, which can be shared among family members for collaborative budgeting.

Pros: Free basic version; excellent for manual budgeting enthusiasts. Stands out for its strong focus on intentional spending and saving.

Cons: Requires manual transaction entry, which can be time-consuming.

Cost: Free; Premium at $10/month or $80/year.

EveryDollar

Created by financial expert Dave Ramsey, EveryDollar follows his financial principles and zero-based budgeting approach. Users assign every dollar to an expense until there’s nothing left. The free version is basic but functional, requiring manual transaction entry. Offers manual budgeting in the free version, with bank syncing in the premium version.

Pros: Free basic version; aligned with Ramsey’s financial principles.

Cons: Manual categorization in both versions; premium features cost extra.

Cost: Free; Premium at $79.99/year or $17.99/month after trial.

Empower

Previously known as Personal Capital, Empower now focuses on wealth management and investment alongside budgeting. The free version offers powerful investment analysis tools, retirement planning features, and net worth tracking.

It’s particularly suitable for users with significant investment portfolios who want detailed analysis of their investments alongside basic budgeting capabilities. The app also offers paid wealth management services for high-net-worth individuals.

Pros: Free to use; comprehensive for investment-focused users.

Cons: Investment management fees might apply for those seeking personalized advice.

Cost: Free for basic services; investment management starts at a $100,000 minimum investment for 0.89% management fee.

Credit Karma

Initially known for free credit score checks, Credit Karma has positioned itself more as a financial health platform rather than a traditional budgeting app. Based on a credit-first approach to financial management, the app stands out for its credit simulator feature and comprehensive marketplace of financial products, helping users make informed decisions about loans, credit cards, and insurance without impacting their credit score.

It also offers tools for net worth tracking and spending insights. Although it lacks the comprehensive budgeting features of its predecessors like Mint, it is still a valuable tool for those primarily interested in managing and enhancing their credit.

Pros: Completely free; provides credit score and report from TransUnion and Equifax; offers personalized financial product recommendations and basic budgeting tools, while also providing complimentary tax filing services.

Cons: Limited in terms of budgeting; heavily focused on credit and loan products which can lead to targeted ads; user complaints about the transition from Mint include less detailed financial management.

Cost: Free, with revenue from financial product recommendations.

Honeydue

Specifically designed for couples, Honeydue facilitates financial collaboration between partners. It allows couples to share account information, track bills together, and communicate about spending within the app.

The app includes features like bill reminders, shared expense tracking, and even a joint banking option. It’s free to use, making it an excellent choice for couples looking to manage their finances together.

Pros: Free; enhances financial transparency between partners.

Cons: Contains ads; less comprehensive than some standalone budgeting apps.

Cost: Free with optional in-app purchases.

Choosing the Right App

When selecting a budgeting and expense tracking app, consider:

- Your specific financial goals and needs

- The complexity level you’re comfortable with

- Whether you prefer a free app with basic features or are willing to pay for premium features

- The app’s compatibility with your financial institutions

- The security measures implemented by the app

Making the Most of Your Chosen App

To maximize the benefits of these financial tools:

- Take time to learn all available features

- Regularly review and adjust your budgets as needed

- Use the insights provided to make informed financial decisions

- Take advantage of educational resources many apps provide

- Set up notifications to stay on track with your financial goals

User Experience and Privacy

User experience has seen significant improvements, with apps designed for ease of use, often incorporating gamification to make budgeting more engaging. However, with the increase in digital financial management comes the critical issue of privacy and security.

Security Considerations

As these apps handle sensitive financial information, security is paramount. Most reputable apps employ bank-level encryption, two-factor authentication, and other security measures to protect user data. However, users should still be exercising caution by:

- Choosing apps from established companies with strong security track records

- Using strong, unique passwords for their accounts

- Enabling all available security features, including biometric authentication when available

- Frequent monitoring of any suspicious activity in their accounts

Integration with Modern Banking

Many traditional banks now offer their own budgeting and expense tracking features within their mobile banking apps, recognizing the value these tools provide to customers. This integration can simplify financial management by keeping all banking and budgeting functions in one place, though these built-in tools may not be as comprehensive as dedicated budgeting apps.

Challenges and Considerations

While these apps have made budgeting more accessible, there are still challenges:

- Learning Curve: Some apps can be complex, requiring time to fully utilize their capabilities.

- Subscription Costs: Many top-tier apps require a subscription fee for full functionality, which might not be cost-effective for everyone.

- Data Accuracy: Automatic categorization can sometimes be flawed, necessitating manual corrections, which can be tedious.

- Integration: Not all financial institutions sync seamlessly with all apps, leading to incomplete financial pictures if a user’s bank isn’t supported.

Looking Forward

The future of budgeting and expense tracking apps looks promising, with emerging technologies set to enhance their capabilities further. Artificial intelligence and machine learning are being incorporated to provide more personalized financial advice and predictive analytics. Some apps are beginning to integrate cryptocurrency tracking and investment features, reflecting the evolving nature of personal finance.

Final Thoughts

Budgeting and expense tracking apps have revolutionized personal finance management, making it easier than ever to maintain financial health and work toward long-term goals. Whether you’re a novice looking to get a grip on your finances or a seasoned investor needing a detailed overview, there’s an app designed to meet your needs, making financial management less of a chore and more of a strategic, engaging part of life.

While these tools can’t guarantee financial success, they provide the structure and insights needed to make better financial decisions. As technology continues to evolve, these apps will likely become even more sophisticated, offering increasingly personalized and comprehensive financial management solutions.